The 8-Second Trick For Pvm Accounting

The 8-Second Trick For Pvm Accounting

Blog Article

Pvm Accounting Can Be Fun For Anyone

Table of Contents9 Easy Facts About Pvm Accounting DescribedPvm Accounting Things To Know Before You Get ThisLittle Known Questions About Pvm Accounting.The Of Pvm AccountingSome Known Questions About Pvm Accounting.Pvm Accounting for Beginners

Manage and handle the development and authorization of all project-related invoicings to customers to cultivate good communication and prevent problems. Clean-up accounting. Guarantee that proper reports and documents are sent to and are updated with the internal revenue service. Ensure that the accounting process follows the legislation. Apply called for building audit requirements and treatments to the recording and reporting of building activity.Communicate with numerous funding companies (i.e. Title Firm, Escrow Company) pertaining to the pay application procedure and requirements needed for settlement. Assist with applying and preserving internal monetary controls and procedures.

The above statements are meant to explain the general nature and degree of work being executed by people appointed to this classification. They are not to be construed as an extensive listing of responsibilities, responsibilities, and abilities needed. Personnel may be required to do responsibilities outside of their typical responsibilities every so often, as required.

The Ultimate Guide To Pvm Accounting

Accel is looking for a Building Accountant for the Chicago Workplace. The Building and construction Accounting professional does a range of bookkeeping, insurance coverage compliance, and project management.

Principal obligations consist of, however are not restricted to, dealing with all accounting features of the business in a prompt and accurate fashion and providing records and timetables to the company's certified public accountant Firm in the prep work of all financial statements. Makes certain that all bookkeeping treatments and functions are handled properly. In charge of all financial documents, payroll, financial and daily procedure of the accounting function.

Works with Project Managers to prepare and post all monthly invoices. Generates monthly Job Price to Date records and functioning with PMs to integrate with Task Supervisors' budget plans for each project.

Fascination About Pvm Accounting

Proficiency in Sage 300 Construction and Realty (previously Sage Timberline Office) and Procore building and construction management software program a plus. https://spotless-pea-22d.notion.site/Demystifying-Construction-Accounting-Your-Ultimate-Guide-5f9fc548c683420fabff40afc3d0c8fe. Need to also be competent in various other computer system software application systems for the preparation of records, spreadsheets and other accounting evaluation that may be needed by administration. construction accounting. Have to possess solid organizational abilities and capability to focus on

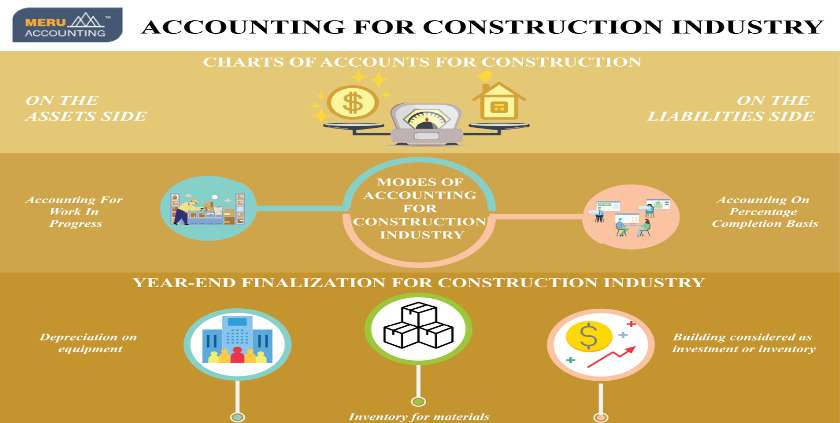

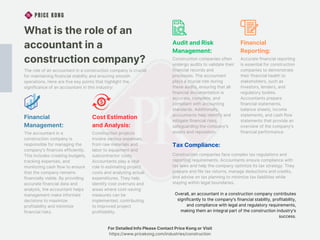

They are the financial custodians that guarantee that building and construction jobs continue to be on budget plan, abide with tax laws, and maintain economic transparency. Building and construction accounting professionals are not just number crunchers; they are strategic partners in the building and construction process. Their main duty is to manage the economic aspects of building tasks, ensuring that sources are alloted efficiently and monetary threats are reduced.

Everything about Pvm Accounting

They work very closely with task supervisors to create and keep an eye on spending plans, track expenditures, and projection economic demands. By keeping a tight grip on job funds, accounting professionals aid protect against overspending and economic troubles. Budgeting is a cornerstone of effective construction tasks, and building and construction accounting professionals contribute hereof. They create detailed budgets that encompass all project expenses, from products and labor to authorizations and insurance.

Navigating the complex web of tax obligation guidelines in the building industry can be tough. Building accountants are well-versed in these regulations and make certain that the job follows all tax obligation demands. This consists of managing payroll tax obligations, have a peek here sales taxes, and any kind of various other tax commitments certain to construction. To succeed in the function of a building accountant, people require a strong educational structure in bookkeeping and finance.

Additionally, accreditations such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Market Financial Expert (CCIFP) are extremely related to in the sector. Building and construction projects typically entail limited deadlines, altering laws, and unexpected expenses.

Pvm Accounting for Beginners

Ans: Building and construction accounting professionals develop and keep an eye on budget plans, determining cost-saving opportunities and guaranteeing that the project remains within spending plan. Ans: Yes, building and construction accounting professionals handle tax compliance for building projects.

Introduction to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make difficult selections among many financial choices, like bidding process on one job over another, picking funding for products or tools, or establishing a job's earnings margin. Construction is an infamously volatile sector with a high failure price, sluggish time to settlement, and inconsistent cash flow.

Typical manufacturerConstruction company Process-based. Manufacturing includes repeated procedures with conveniently recognizable expenses. Project-based. Production calls for various processes, materials, and tools with differing expenses. Repaired location. Production or manufacturing happens in a single (or numerous) controlled locations. Decentralized. Each task takes area in a new location with differing site problems and special difficulties.

Top Guidelines Of Pvm Accounting

Frequent use of various specialized contractors and vendors influences efficiency and money circulation. Settlement arrives in full or with routine settlements for the complete agreement quantity. Some portion of payment may be kept up until job conclusion also when the service provider's work is finished.

While standard makers have the advantage of controlled settings and enhanced production procedures, building companies must frequently adjust to each new task. Even somewhat repeatable tasks call for alterations due to website conditions and other factors.

Report this page